How to modernize payments and drive growth

- Speedsters

- Mar 20, 2023

- 5 min read

Updated: Apr 5, 2023

As technology continues to reshape the world of finance, payment modernization becomes a possibility for businesses and government agencies of all sizes. Gone are the days when only the most prominent companies could afford to sit at the table of the newest trends and leading technologies. Instead, fintechs have shed new light on how emerging technologies can optimize traditional payment rails. The common obstacles, such as cost and intricacy of innovation, are no longer the blockers they once were. Today, cloud computing and free-to-use platforms lay a foundation for companies looking to begin modernizing their payments.

What is payment modernization?

Payment modernization is the process of transforming traditional payment systems to compete in a forever-evolving digital economy. The definition of payment modernization changes slightly depending on the source, but its goal remains the same. Use modern technology to bring speed, visibility, control, and security into your payment and back-office activities.

In an insight series titled Journey to Payments Modernization, Mastercard reviews 81 global markets and reveals the three main drivers of payments modernization to be:

"Increasing overall payment system efficiency and reducing costs."

"Increased demand for secure, convenient digital transactions."

"Expanding access to financial products and services."

Can Speedchain help modernize my payments?

Absolutely! Speedchain is a cloud-native payment platform built from the ground up to reimagine business finance. Mastercard refers to cloud computing as “one of the most important advances in recent years.” Mastercard explains that “the use of cloud environments is an entirely different approach to managing payments, providing more flexibility, efficiency, and scalability while potentially providing equal levels of resiliency.” Speedchain is free to use and offers products and services designed to solve various payment-related challenges.

In a press release announcing the Speedchain & Mastercard partnership, Marie Elizabeth Aloisi, executive vice president, Commercial Solutions at Mastercard, explains

“Mastercard is committed to modernizing payments around the world – and we’re doing that today with partners like Speedchain by reinventing how businesses send and receive payments.” “Pairing Speedchain’s data-rich platform with Mastercard’s multi-rail capabilities, we are unlocking new opportunities for public and private sector companies large and small.”

The supplier activation approach

One of the unique services offered to Speedchain members is supplier activation. Speedchain leverages rich data from the card issuer network to discover all the companies that accept card payments in a member's supplier network (anyone they buy goods or services from). Then, their success team collaborates with the member's accounts payable department and CFO's office to work with suppliers and shift payments from paper checks to more productive payment methods. Suppliers are the lifeblood of a company’s business, so Speedchain's success team conducts supplier activation with a white-glove approach. Every step of the process is handled with care and on behalf of the members, with their relationship being the top priority.

Advice for the journey

We believe the correct approach is to fully understand a member's challenges so the right-sized solution can be recommended. In addition, businesses and government agencies will have different payment portfolios and unique challenges to achieve their goals, so there may be better choices than a one size fits all solution.

Here are a few things to remember as you get started

Internal evaluation - Identify the challenges in your payment and accounting activities. What challenges have plagued you, and what goals do you have for the future? Include different team members in the discussion.

Take your time - Don't get too caught up in the latest trends and buzzwords. Instead, focus on whichever solution provider prioritizes your timeline and goals. A quality solution provider should be able to tailor their product to your needs.

Request demos - Don't be shy, have some fun with your search. Get to know the people at the company you are researching. The only way to know if you like something is to see it in action.

Be open-minded - As humans, we naturally resist change. So be open-minded to a new process if it fits your needs.

Once you have decided on an approach that works for your team and chosen your optimal products and partnerships, modernizing should be a breeze. First, focus on increasing efficiency and productivity for your finance team by reducing busy manual work and increasing control and security. Getting started can be as simple as using virtual cards rather than physical credit/debit cards. Virtual cards are credit/debit cards without the physical form and provide more benefits than their physical counterparts. For those who have corporate card programs and issue physical cards to employees but desire more control, security, and visibility into real-time transaction data, check out the Speedchain OneCard.

A Speedchain member case study

"We have an accounts payable portfolio representing all types of payments. SpeedChain has helped us streamline, optimize, secure, and manage the performance of our payables. The SpeedChain team is experienced and highly effective. It has been a great decision to partner with them.”

Before partnering with Speedchain, this member relied heavily upon issuing paper checks to pay their suppliers. Unfortunately, check payments present several time and money-related inefficiencies that can be difficult to quantify. Simply the amount of employee time and salary wasted in chasing lost or stolen checks, re-issuing, and attempting to reconcile check payments accurately can be a nightmare! The inefficiencies in check payments are one of the reasons we offer supplier activation; let's look at the numbers.

Supplier activation drives growth!

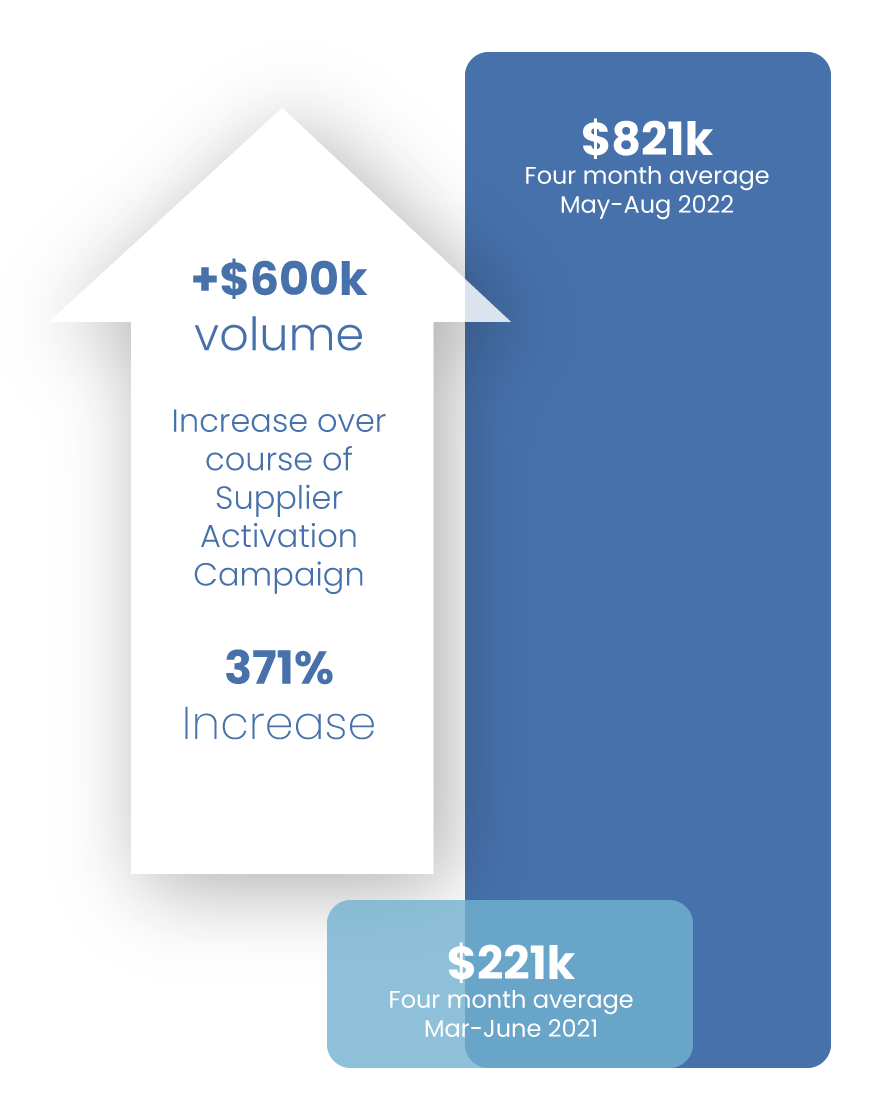

After launching the supplier activation service, within a year, this member almost 10x-ed their number of suppliers accepting card payments and increased card volume by nearly 4x, or $600,000.

What are the benefits?

So much to unpack here.

Time saved - Time is money, and sending and receiving checks requires too much time. They have to be printed, mailed, accepted, and then processed. That's a lot of hands to pass through and many opportunities for the check to be lost or stolen. If a check payment is lost or stolen, the process starts over again, creating more busy work for your finance team.

Increased Card Volume - Card payments are instant, secure, and easily reconciled, benefiting you and your supplier. Every payment moved from a check to a virtual card is a security, visibility, and control upgrade for your finance team. Additionally, your finance team can spend more time on strategic operations and less on busy manual work.

Relationships strengthened - If there is one thing a supplier's accounts receivable team dislikes, it's overdue invoices. An unhappy accounts receivable team usually turns into an unhappy CFO, and aggravating the decision-makers is a great way to erode relationships with trade partners. In our experience, most suppliers are open to moving away from receiving checks. Some are even open to negotiating discounts for early payments. Talk about a win-win!

Revenue generated - Card payments come with a magical thing known as a rebate or cash-back! The more card transaction volume your accounts payable department issues, the more cashback your business receives.

What if some suppliers insist on still receiving check payments? Consider a managed check solution if you are manually sending checks. Check solutions like the one offered to Speedchain members relieve the manual workload for finance teams and provide richer data. If you include employee time with the cost of manually managing checks, a solution's price is more affordable than doing it yourself. Remember, one of the biggest drivers of payment modernization is to increase efficiency and reduce costs.

Final thoughts

The actions needed to achieve payment modernization will differ for everyone, but they don't need to be complicated. Start by identifying the challenges currently zapping your team's productivity and take your time in the evaluation. Trust the team members on the front lines and involve them in the discussion. Most teams may know the symptoms but are still determining if a solution exists. A quality solution provider should assist in discovering additional areas of improvement, so request the demo and see what they bring to the table.

Want to learn more about supplier activation or Speedchain's spend management platform? Contact a Speedster today!

Comments