The Power of Connected Systems in Construction Finance

The Power of Connected Systems in Construction Finance

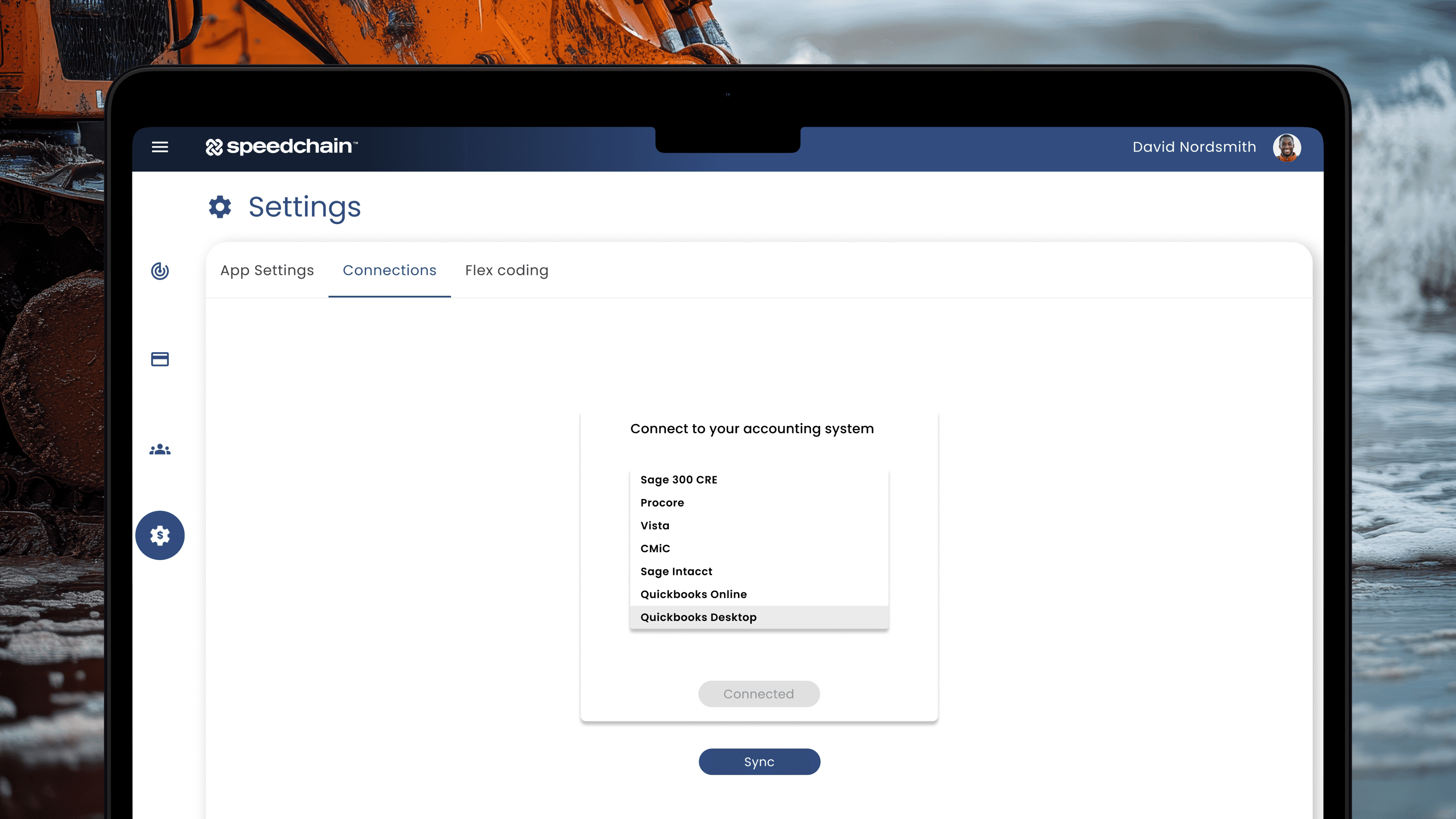

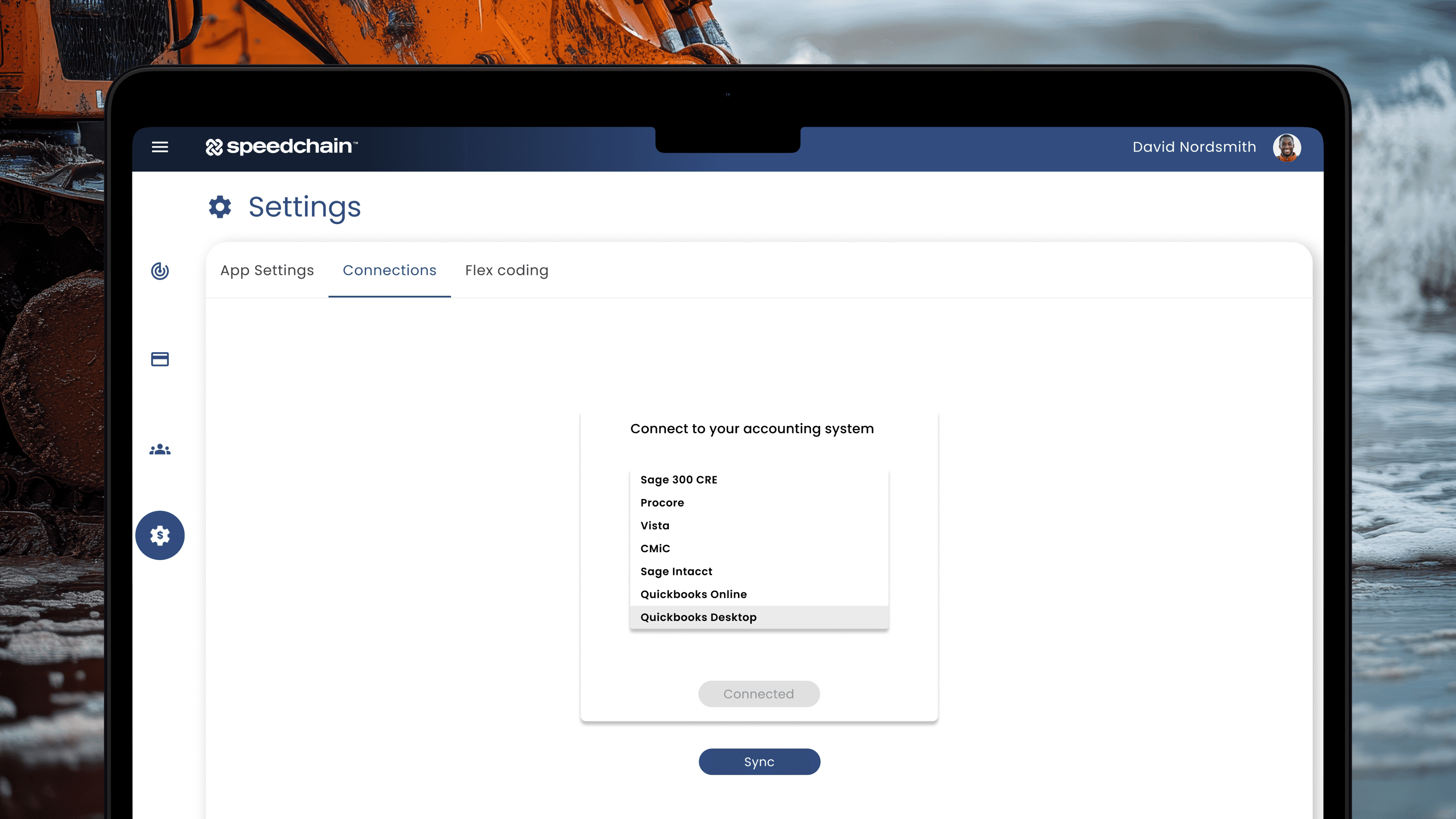

Construction finance teams typically work with layers of integrations. Every ERP, expense tool, and bank program promises automation. But in reality, most controllers are still moving data manually between multiple systems.

When this happens, workflows are slowed down due to the lack of connectivity. Each tool becomes a separate source of truth that can easily lead to confusion or inaccuracies. And as long as financial information is trapped in silos, accuracy and efficiency suffer. Modern construction accounting depends on seamless integrations between platforms.

The controller’s reality

During a typical workday, controllers are toggling between multiple disconnected platforms. One system holds vendor payments, another manages corporate cards, a third tracks project budgets. By the time data makes its way to the ERP, it is very likely outdated. This fragmentation is both inconvenient for the team and a deterrent to financial clarity.

A general contractor recently described their workflow as automation by spreadsheet. Each month, their AP team downloads transactions from a corporate card portal, codes them manually in Excel, and uploads the data into their accounting software. It typically takes multiple business days to complete the process, and still requires manual review to catch any corrections. But unsurprisingly, each tool they use advertises automation.

Without true integration, finance teams spend valuable hours on process workarounds rather than focusing on strategic analysis. This escalates as the company adopts more systems, introducing more manual cleanup into the workflow.

Disconnected tools

Disconnected systems create three recurring problems in construction finance:

Data delay: Spend information arrives too late to influence decisions.

Duplicate entry: The same data gets rekeyed across systems, increasing error risk and reinforcing manual processes.

Version confusion: Reports from different financial tools do not accurately reconcile, leaving teams to spend time determining which numbers are right.

These three issues can quickly snowball across jobsites. Each project has its own cost codes, managers, budgets, and timelines. Without seamless integrations, controllers are left matching transactions to the right project after the fact. By the time budgets are updated, the data no longer reflects reality.

The impact reaches beyond finance and impacts the entire organization. Project managers have difficulty trusting the numbers on financial reports, CFOs lose accuracy in forecasts, and leadership loses visibility into cash flow. What appears to be a frustratingly manual process can actually be a large disconnect slowing everything down.

The price of fragmentation in construction tech compounds. For example, if each controller spends two hours a week fixing mismatched data between expense reports and ERP uploads, it can add up to thousands of hours a year, or the equivalent of full-time salaries lost to rework.

The operational cost is even higher. Financial reports based on outdated information become lagging indicators of project health. It becomes difficult to catch overspending early or adjust resource allocations mid-project.

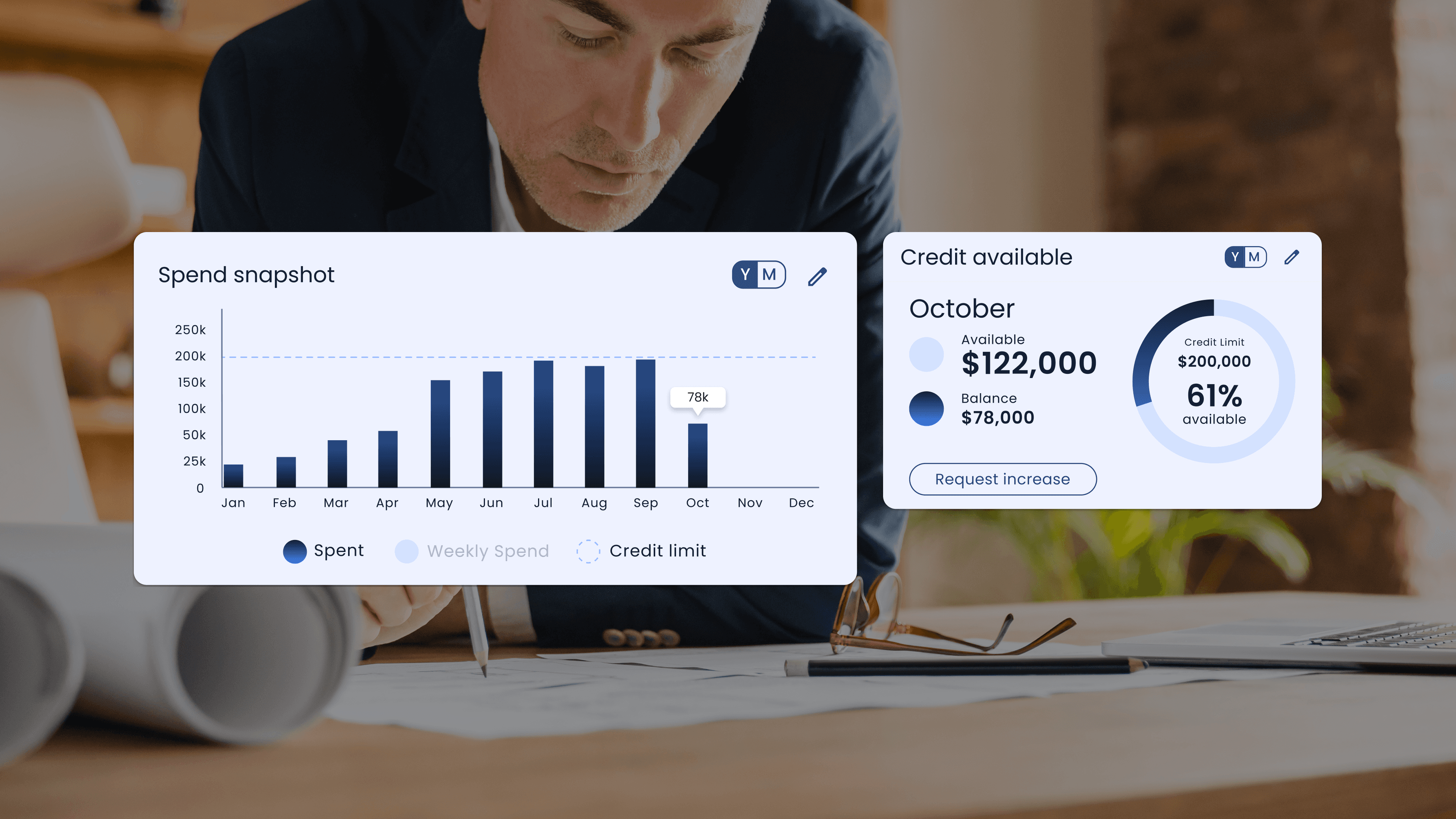

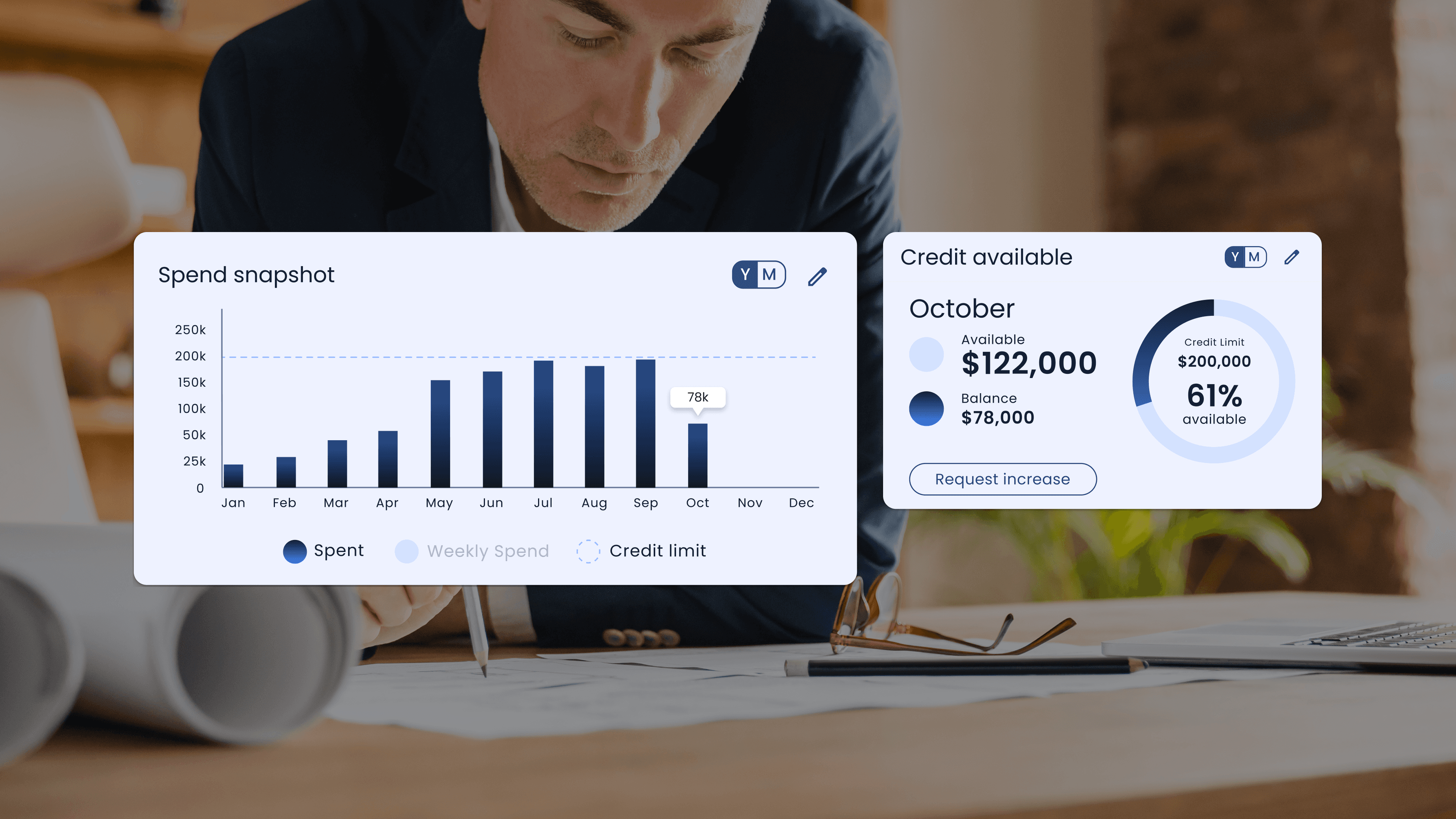

Real-time visibility

Integrations transform day-to-day operations almost immediately. In expense management, real-time synchronization between platforms means controllers no longer wait for end-of-month imports to understand spend. They now see transactions as spending occurs, identify anomalies, and communicate with PMs while the project is active.

For example, a contractor using integrated expense management and ERP integration might identify a spend overrun mid-cycle rather than after the quarter ends. Because spend data flows instantly from their credit card program to their accounting system, the controller catches the issue and reclassifies it before invoicing. The result is a cleaner close and a more accurate forecast.

Construction finance teams typically work with layers of integrations. Every ERP, expense tool, and bank program promises automation. But in reality, most controllers are still moving data manually between multiple systems.

When this happens, workflows are slowed down due to the lack of connectivity. Each tool becomes a separate source of truth that can easily lead to confusion or inaccuracies. And as long as financial information is trapped in silos, accuracy and efficiency suffer. Modern construction accounting depends on seamless integrations between platforms.

The controller’s reality

During a typical workday, controllers are toggling between multiple disconnected platforms. One system holds vendor payments, another manages corporate cards, a third tracks project budgets. By the time data makes its way to the ERP, it is very likely outdated. This fragmentation is both inconvenient for the team and a deterrent to financial clarity.

A general contractor recently described their workflow as automation by spreadsheet. Each month, their AP team downloads transactions from a corporate card portal, codes them manually in Excel, and uploads the data into their accounting software. It typically takes multiple business days to complete the process, and still requires manual review to catch any corrections. But unsurprisingly, each tool they use advertises automation.

Without true integration, finance teams spend valuable hours on process workarounds rather than focusing on strategic analysis. This escalates as the company adopts more systems, introducing more manual cleanup into the workflow.

Disconnected tools

Disconnected systems create three recurring problems in construction finance:

Data delay: Spend information arrives too late to influence decisions.

Duplicate entry: The same data gets rekeyed across systems, increasing error risk and reinforcing manual processes.

Version confusion: Reports from different financial tools do not accurately reconcile, leaving teams to spend time determining which numbers are right.

These three issues can quickly snowball across jobsites. Each project has its own cost codes, managers, budgets, and timelines. Without seamless integrations, controllers are left matching transactions to the right project after the fact. By the time budgets are updated, the data no longer reflects reality.

The impact reaches beyond finance and impacts the entire organization. Project managers have difficulty trusting the numbers on financial reports, CFOs lose accuracy in forecasts, and leadership loses visibility into cash flow. What appears to be a frustratingly manual process can actually be a large disconnect slowing everything down.

The price of fragmentation in construction tech compounds. For example, if each controller spends two hours a week fixing mismatched data between expense reports and ERP uploads, it can add up to thousands of hours a year, or the equivalent of full-time salaries lost to rework.

The operational cost is even higher. Financial reports based on outdated information become lagging indicators of project health. It becomes difficult to catch overspending early or adjust resource allocations mid-project.

Real-time visibility

Integrations transform day-to-day operations almost immediately. In expense management, real-time synchronization between platforms means controllers no longer wait for end-of-month imports to understand spend. They now see transactions as spending occurs, identify anomalies, and communicate with PMs while the project is active.

For example, a contractor using integrated expense management and ERP integration might identify a spend overrun mid-cycle rather than after the quarter ends. Because spend data flows instantly from their credit card program to their accounting system, the controller catches the issue and reclassifies it before invoicing. The result is a cleaner close and a more accurate forecast.

Looking ahead

When financial data flows seamlessly between systems, finance teams can focus on analysis, strategy, and growth. Ideally, every system, from ERP, to expense, payroll, and procurement, should feed one version of truth.

Looking ahead

When financial data flows seamlessly between systems, finance teams can focus on analysis, strategy, and growth. Ideally, every system, from ERP, to expense, payroll, and procurement, should feed one version of truth.