Why Financial Controls Must Scale with Your Business

Why Financial Controls Must Scale with Your Business

In construction, financial control and trust are built on accurate, timely, and complete numbers. As companies scale, maintaining financial control becomes increasingly difficult. Systems strain, processes break, and the tools that once worked are unable to scale. At that point, the right infrastructure makes all the difference.

Why scaling construction finance is difficult

Growth in construction rarely happens at an even pace. One quarter you’re managing five projects, the next, you’re managing fifty. Each new job brings more vendors, more jobsite transactions, and greater financial complexity. Often, the systems built for a smaller operation quickly reach their limit.

For construction finance teams, scaling means balancing speed with accuracy. Financial controls must expand seamlessly with your business. Data must flow at the speed of business, without sacrificing reliability. The challenge isn’t just volume, it’s visibility.

If your projects are doubling, and your financial visibility isn’t keeping pace, you start to run into problems. By the time you know where an issue is, projects are closed. That lag between execution and insight defines the growing pains of construction finance.

The risk of outgrowing your financial management tools

Many construction companies rely on legacy corporate card programs or disconnected expense systems that aren’t designed for project-based work. These tools work when the company is small, but they begin to crack under scale.

Common symptoms of outgrowing financial tools:

Manual reconciliation overload: Your finance team spends days matching transactions across systems.

Inconsistent coding: More users mean more errors, especially when project and cost codes aren’t enforced automatically by the system.

Limited visibility: Traditional tools enable spend but don’t show details by project, cost code, cost type, or vendor.

As your organization grows, these inefficiencies continue to compound. Instead of benefiting from scale, your teams start to feel constrained by current processes.

The technology trust factor

In construction finance, trust operates on two levels: internal and external.

Internally, field teams trust that finance will deliver accurate reports and timely payments. Finance teams trust that the field will code expenses and capture receipts correctly. When either side loses confidence, collaboration breaks down.

Externally, clients and auditors trust the company’s data integrity. Delays, discrepancies, or missing documentation can erode trust and possibly impact future contracts or bonding capacity.

Maintaining trust at scale requires systems that enforce accuracy automatically. The larger your company, the greater the need for dependable controls.

In construction, financial control and trust are built on accurate, timely, and complete numbers. As companies scale, maintaining financial control becomes increasingly difficult. Systems strain, processes break, and the tools that once worked are unable to scale. At that point, the right infrastructure makes all the difference.

Why scaling construction finance is difficult

Growth in construction rarely happens at an even pace. One quarter you’re managing five projects, the next, you’re managing fifty. Each new job brings more vendors, more jobsite transactions, and greater financial complexity. Often, the systems built for a smaller operation quickly reach their limit.

For construction finance teams, scaling means balancing speed with accuracy. Financial controls must expand seamlessly with your business. Data must flow at the speed of business, without sacrificing reliability. The challenge isn’t just volume, it’s visibility.

If your projects are doubling, and your financial visibility isn’t keeping pace, you start to run into problems. By the time you know where an issue is, projects are closed. That lag between execution and insight defines the growing pains of construction finance.

The risk of outgrowing your financial management tools

Many construction companies rely on legacy corporate card programs or disconnected expense systems that aren’t designed for project-based work. These tools work when the company is small, but they begin to crack under scale.

Common symptoms of outgrowing financial tools:

Manual reconciliation overload: Your finance team spends days matching transactions across systems.

Inconsistent coding: More users mean more errors, especially when project and cost codes aren’t enforced automatically by the system.

Limited visibility: Traditional tools enable spend but don’t show details by project, cost code, cost type, or vendor.

As your organization grows, these inefficiencies continue to compound. Instead of benefiting from scale, your teams start to feel constrained by current processes.

The technology trust factor

In construction finance, trust operates on two levels: internal and external.

Internally, field teams trust that finance will deliver accurate reports and timely payments. Finance teams trust that the field will code expenses and capture receipts correctly. When either side loses confidence, collaboration breaks down.

Externally, clients and auditors trust the company’s data integrity. Delays, discrepancies, or missing documentation can erode trust and possibly impact future contracts or bonding capacity.

Maintaining trust at scale requires systems that enforce accuracy automatically. The larger your company, the greater the need for dependable controls.

Building scalable financial infrastructure

Scalable financial systems share three characteristics: automation, integration, and adaptability.

Automation reduces manual effort from your finance teams. Receipts, coding, and approvals happen in real time, minimizing delays and errors in reporting.

Integration connects every financial touchpoint, including credit cards, ERP, AP, and payroll, so that data moves quickly and seamlessly.

Adaptability allows you to manage multiple projects from one platform at scale.

When these three elements align, scale becomes an advantage rather than a strain. Finance teams can handle higher transaction volumes without losing control, visibility, or time.

Building scalable financial infrastructure

Scalable financial systems share three characteristics: automation, integration, and adaptability.

Automation reduces manual effort from your finance teams. Receipts, coding, and approvals happen in real time, minimizing delays and errors in reporting.

Integration connects every financial touchpoint, including credit cards, ERP, AP, and payroll, so that data moves quickly and seamlessly.

Adaptability allows you to manage multiple projects from one platform at scale.

When these three elements align, scale becomes an advantage rather than a strain. Finance teams can handle higher transaction volumes without losing control, visibility, or time.

The role of data credibility

At scale, every financial decision depends on data integrity. It is difficult to properly analyze trends or manage cash flow if the underlying numbers are inconsistent. Scalable infrastructure provides better, higher quality data.

High-quality data equips your teams with confidence to make faster decisions based on a single source of financial truth.

On the other hand, inaccurate or incomplete data undermines credibility. Once trust in financial reports erodes, even accurate numbers get questioned. That’s why scalable infrastructure supports both efficiency and reputation.

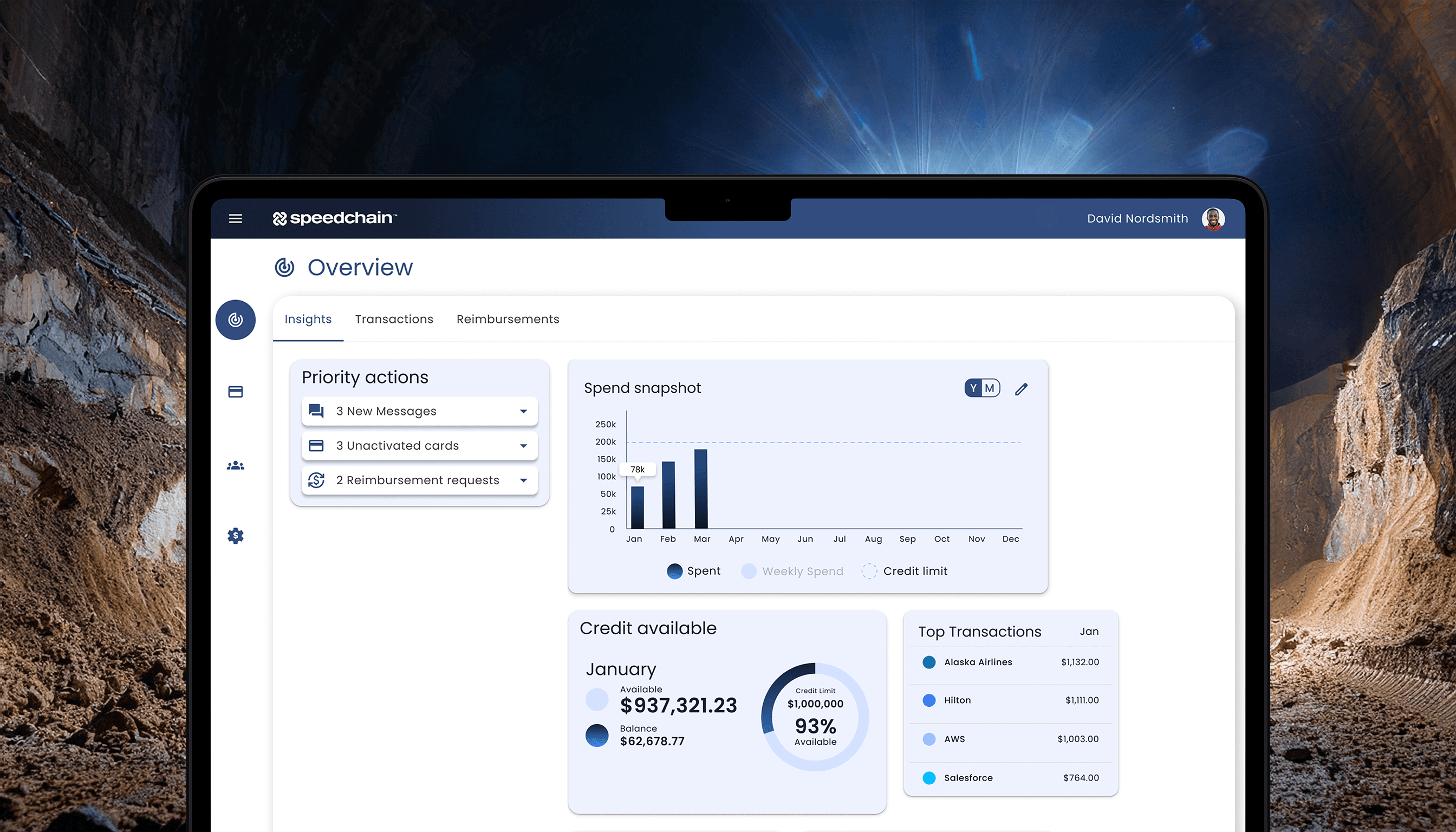

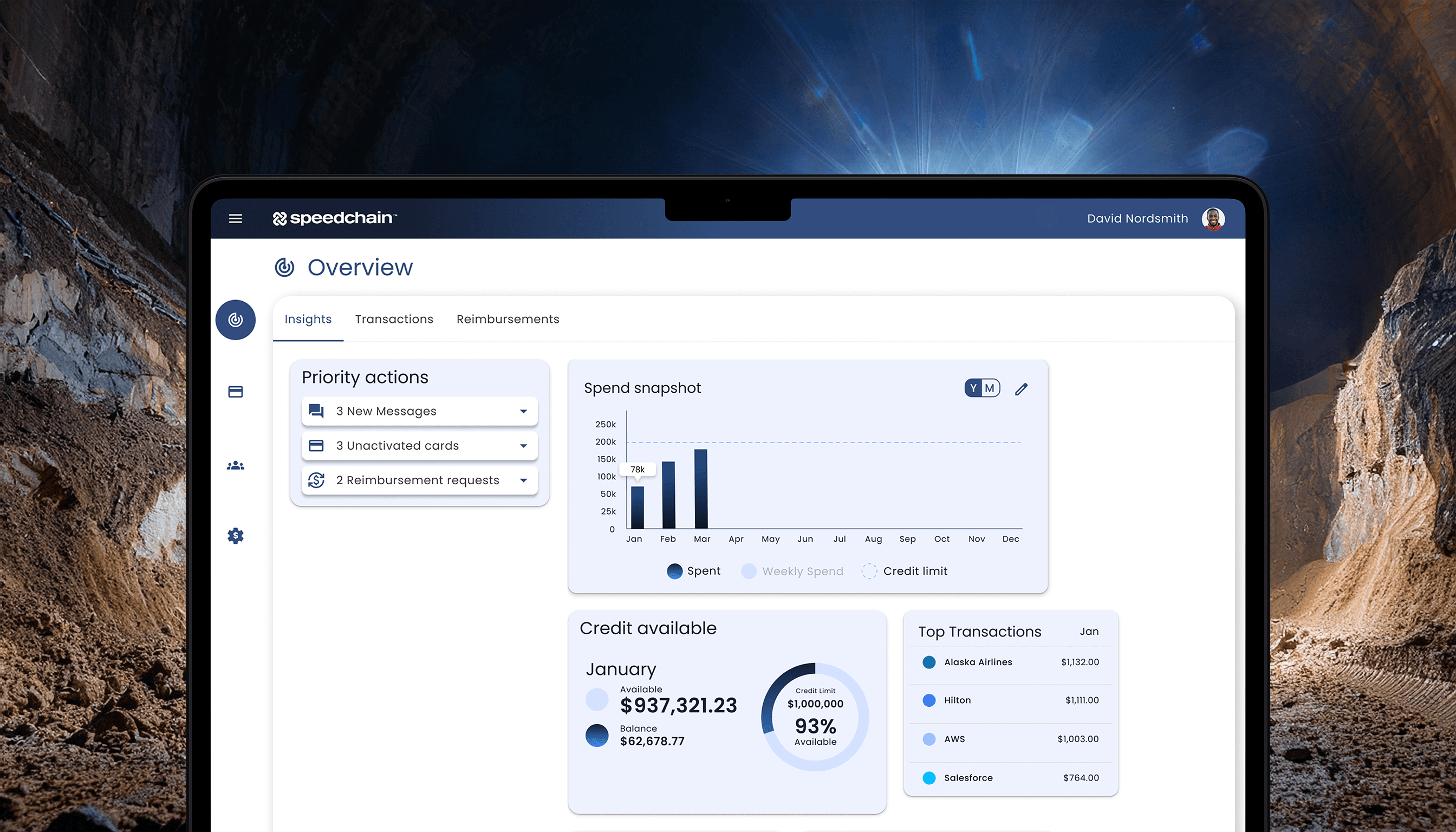

How Speedchain builds for scale

Speedchain is a commercial credit card and modern expense management platform designed specifically for the complexity of construction. It provides the financial backbone that keeps data consistent, accurate, and transparent as you scale.

With Speedchain, each transaction is easily coded at the point of purchase and automatically synced with your existing ERP. Administrators can manage thousands of cards, users, and transactions across projects in real time. The platform’s structure supports both granular project-level visibility and enterprise-level oversight.

The platform’s settings ensure every transaction carries its full documentation, receipt, project codes, and approvals, eliminating any data gaps that cause issues at scale. That equates to confidence in every number that leaves the finance department.

The bigger picture

As construction enters a new era of modern finance, it’s critical to adopt scalable systems. These systems build trust through consistent, repeatable performance. Finance leaders who build scalable infrastructure are enabling growth and operational excellence.

Speedchain gives construction companies financial systems and precision controls that grow with them. Because in this industry, control and credibility are not optional, they’re the foundation for everything that gets built.

The role of data credibility

At scale, every financial decision depends on data integrity. It is difficult to properly analyze trends or manage cash flow if the underlying numbers are inconsistent. Scalable infrastructure provides better, higher quality data.

High-quality data equips your teams with confidence to make faster decisions based on a single source of financial truth.

On the other hand, inaccurate or incomplete data undermines credibility. Once trust in financial reports erodes, even accurate numbers get questioned. That’s why scalable infrastructure supports both efficiency and reputation.

How Speedchain builds for scale

Speedchain is a commercial credit card and modern expense management platform designed specifically for the complexity of construction. It provides the financial backbone that keeps data consistent, accurate, and transparent as you scale.

With Speedchain, each transaction is easily coded at the point of purchase and automatically synced with your existing ERP. Administrators can manage thousands of cards, users, and transactions across projects in real time. The platform’s structure supports both granular project-level visibility and enterprise-level oversight.

The platform’s settings ensure every transaction carries its full documentation, receipt, project codes, and approvals, eliminating any data gaps that cause issues at scale. That equates to confidence in every number that leaves the finance department.

The bigger picture

As construction enters a new era of modern finance, it’s critical to adopt scalable systems. These systems build trust through consistent, repeatable performance. Finance leaders who build scalable infrastructure are enabling growth and operational excellence.

Speedchain gives construction companies financial systems and precision controls that grow with them. Because in this industry, control and credibility are not optional, they’re the foundation for everything that gets built.