How to Control Construction Spending without Friction

How to Control Construction Spending without Friction

As a construction finance leader, you’ve likely faced the uneasy phone call about a missing card, an unapproved purchase, or a late-night transaction that was “probably a mistake.”

Card misuse isn’t always malicious, but it does cost you time, money, and resources to manage. The question is, how can you balance financial oversight without slowing down the field?

The balance between speed and control

Construction moves quickly. Crews purchase materials on the go, project managers pick up urgent orders, and superintendents make judgment calls that keep projects moving. But the same speed that drives this productivity can erode financial control if the right safeguards aren’t put in place.

At the same time, traditional bank programs offer limited visibility into what your teams are spending. You may not see a questionable transaction until the next statement cycle. And by then, the damage is done. The lag between team spending and financial oversight creates both operational and financial exposure.

The operational risks hiding in plain sight

Card misuse in construction often doesn’t look like fraud. Instead, it presents as human error, timing pressure, or unclear policy boundaries:

Personal purchases: An employee accidentally uses their company credit card for fuel or meals that are not tied to a project.

Over-limit charges: Field staff exceed their spending limit on a critical order because they can’t wait for approval before making the purchase.

Vendor drift: Repeated purchases at off-contract suppliers slowly undermine negotiated pricing.

Each of these incidents chips away at your ability to proactively control spending across projects. While these individual occurrences might be small, the cumulative effect can distort your company’s project budgets and consume days of reconciliation work for your team.

The cost of overcorrection

It is easy to respond to card misuse by tightening controls and creating new approval policies. However, the result is often slower workflows, frustrated teams, and shadow purchasing where employees find ways around the system.

Overly strict procedures solve one problem but tend to create another in their wake. When individual purchases require multi-level approvals, projects can begin to stall. Field teams may also begin to perceive finance as a bottleneck rather than a partner. The solution is a middle ground focused on automated processes rather than restrictions.

What smart control looks like

So how can you move from reactive spend management to proactive financial control, without slowing down purchasing? The answer is by creating systems where control happens automatically, in real time, and without constant intervention from finance. The best modern systems have built-in compliance components that free your finance team from constant policing.

Your spend management tool should solve for these three core functions:

Real-time visibility: Every transaction should be visible the moment a purchase is made, allowing finance to monitor spend as it unfolds.

Configurable limits: Spending rules should be adaptable by role, project, and monetary amount. A superintendent’s daily limit differs from a foreman’s, and both differ from a project manager’s.

Automated enforcement: Cards that exceed policy limits, transactions with missing receipts, or unapproved merchants should be able to be paused automatically without manual review.

You’ll realize cost and time savings when finance can define the rules once, and the system can apply them consistently across every card, user, and project.

As a construction finance leader, you’ve likely faced the uneasy phone call about a missing card, an unapproved purchase, or a late-night transaction that was “probably a mistake.”

Card misuse isn’t always malicious, but it does cost you time, money, and resources to manage. The question is, how can you balance financial oversight without slowing down the field?

The balance between speed and control

Construction moves quickly. Crews purchase materials on the go, project managers pick up urgent orders, and superintendents make judgment calls that keep projects moving. But the same speed that drives this productivity can erode financial control if the right safeguards aren’t put in place.

At the same time, traditional bank programs offer limited visibility into what your teams are spending. You may not see a questionable transaction until the next statement cycle. And by then, the damage is done. The lag between team spending and financial oversight creates both operational and financial exposure.

The operational risks hiding in plain sight

Card misuse in construction often doesn’t look like fraud. Instead, it presents as human error, timing pressure, or unclear policy boundaries:

Personal purchases: An employee accidentally uses their company credit card for fuel or meals that are not tied to a project.

Over-limit charges: Field staff exceed their spending limit on a critical order because they can’t wait for approval before making the purchase.

Vendor drift: Repeated purchases at off-contract suppliers slowly undermine negotiated pricing.

Each of these incidents chips away at your ability to proactively control spending across projects. While these individual occurrences might be small, the cumulative effect can distort your company’s project budgets and consume days of reconciliation work for your team.

The cost of overcorrection

It is easy to respond to card misuse by tightening controls and creating new approval policies. However, the result is often slower workflows, frustrated teams, and shadow purchasing where employees find ways around the system.

Overly strict procedures solve one problem but tend to create another in their wake. When individual purchases require multi-level approvals, projects can begin to stall. Field teams may also begin to perceive finance as a bottleneck rather than a partner. The solution is a middle ground focused on automated processes rather than restrictions.

What smart control looks like

So how can you move from reactive spend management to proactive financial control, without slowing down purchasing? The answer is by creating systems where control happens automatically, in real time, and without constant intervention from finance. The best modern systems have built-in compliance components that free your finance team from constant policing.

Your spend management tool should solve for these three core functions:

Real-time visibility: Every transaction should be visible the moment a purchase is made, allowing finance to monitor spend as it unfolds.

Configurable limits: Spending rules should be adaptable by role, project, and monetary amount. A superintendent’s daily limit differs from a foreman’s, and both differ from a project manager’s.

Automated enforcement: Cards that exceed policy limits, transactions with missing receipts, or unapproved merchants should be able to be paused automatically without manual review.

You’ll realize cost and time savings when finance can define the rules once, and the system can apply them consistently across every card, user, and project.

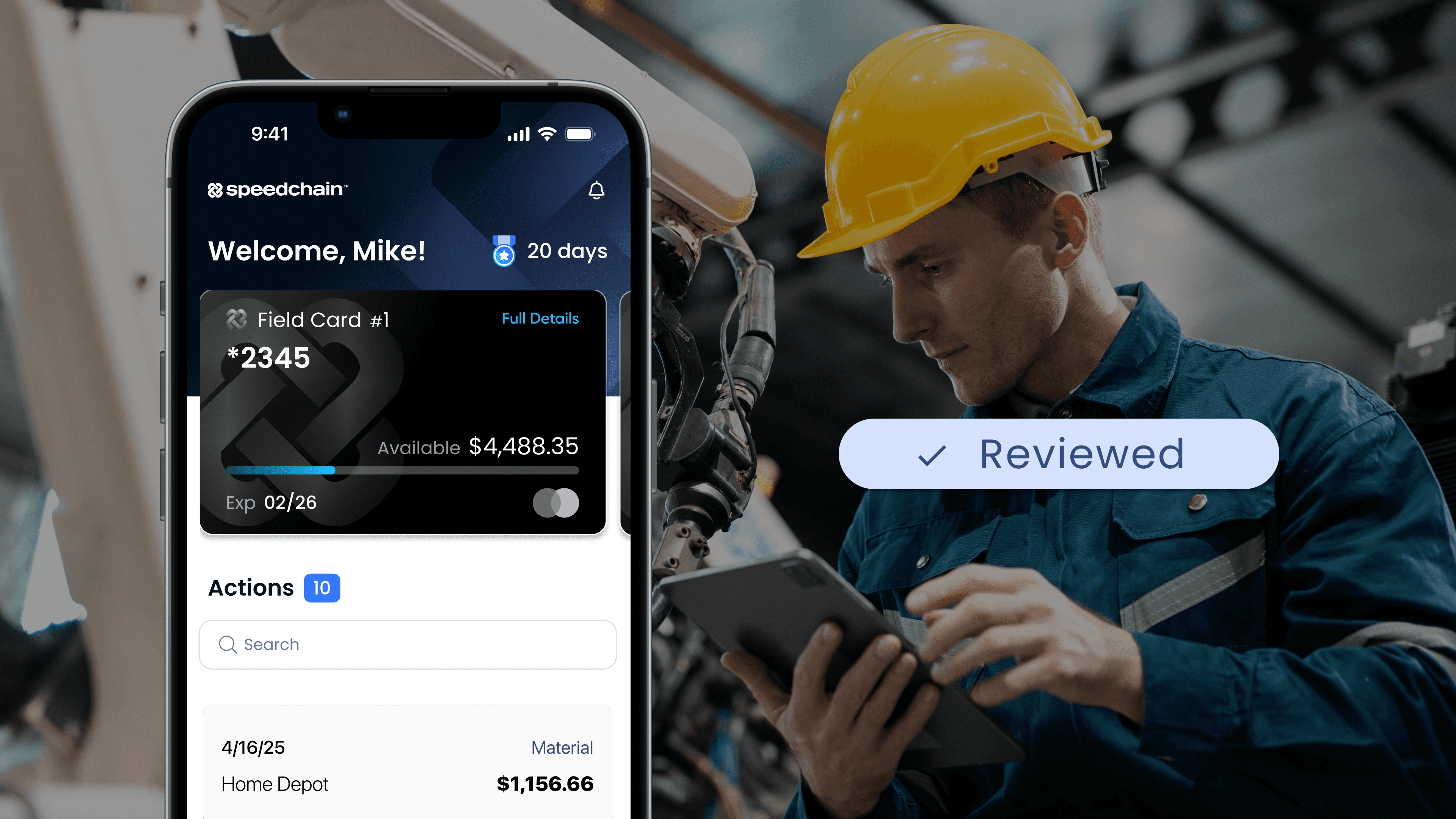

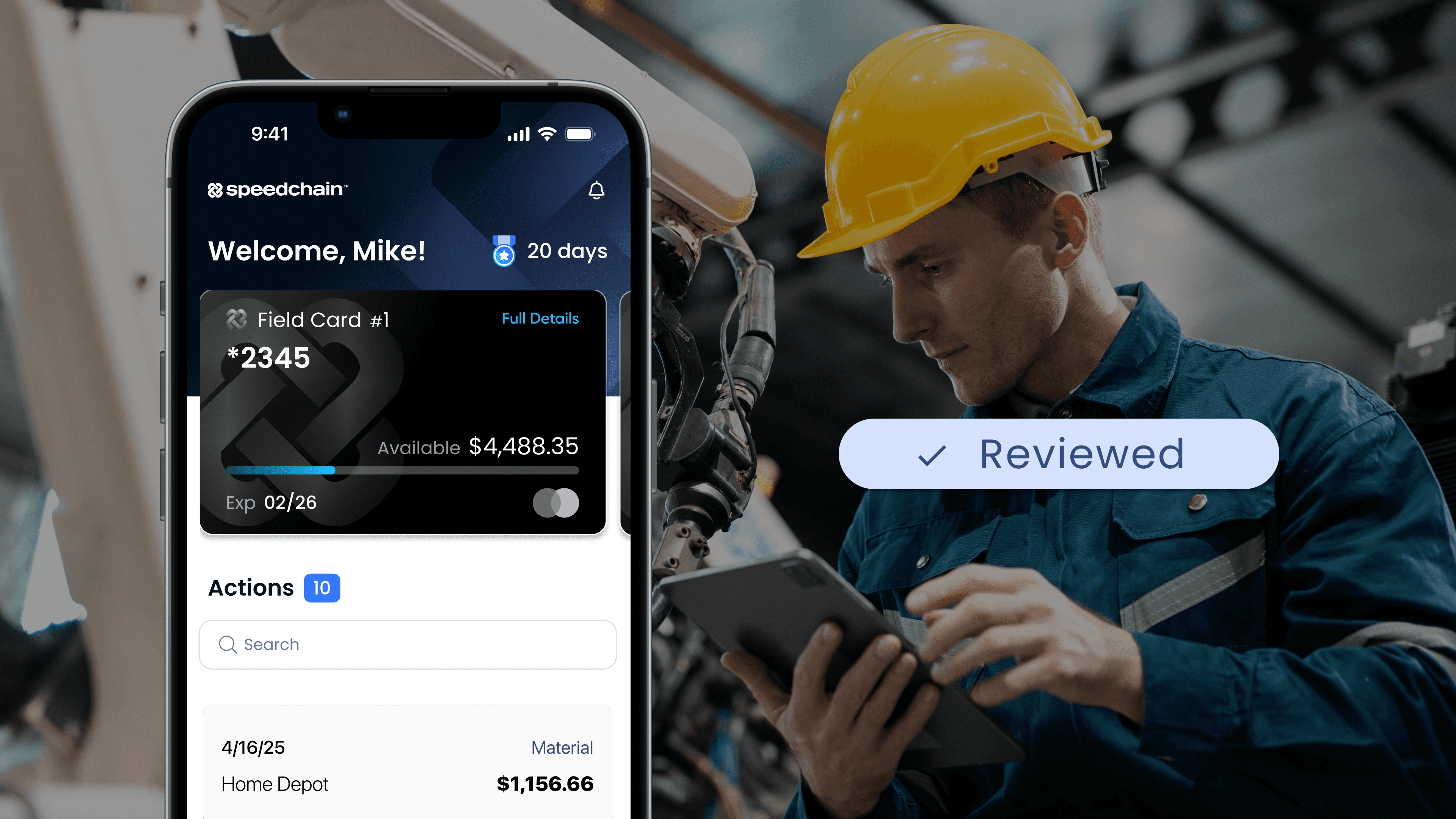

How Speedchain is changing the game

Speedchain is designed for construction, giving you granular control while removing friction from your expense management workflow.

Each Speedchain card can be configured by role, project, and user. Spending limits, merchant categories, and daily caps are fully customizable. If a superintendent exceeds their limit or misses a receipt deadline, cards can be set to pause automatically until compliance is restored. Finance only needs to define the rules once, and the system enforces them consistently.

Because Speedchain updates transactions in real time, you gain full visibility into spending patterns as they emerge. And for field teams, the process feels seamless - no waiting, no paperwork, no delay.

The future of financial control without friction

Embedding automated control systems into your spend workflows will protect project margins, reduce financial risk, and eliminate hours of manual oversight for your finance team.

This level of financial control builds confidence internally and credibility externally, with auditors, partners, and customers alike.

How Speedchain is changing the game

Speedchain is designed for construction, giving you granular control while removing friction from your expense management workflow.

Each Speedchain card can be configured by role, project, and user. Spending limits, merchant categories, and daily caps are fully customizable. If a superintendent exceeds their limit or misses a receipt deadline, cards can be set to pause automatically until compliance is restored. Finance only needs to define the rules once, and the system enforces them consistently.

Because Speedchain updates transactions in real time, you gain full visibility into spending patterns as they emerge. And for field teams, the process feels seamless - no waiting, no paperwork, no delay.

The future of financial control without friction

Embedding automated control systems into your spend workflows will protect project margins, reduce financial risk, and eliminate hours of manual oversight for your finance team.

This level of financial control builds confidence internally and credibility externally, with auditors, partners, and customers alike.