Project-Level Financial Control in Construction

Project-Level Financial Control in Construction

Your 2025 guide to protecting project margins in a volatile market.

Project budget overruns are nothing new. But in 2025, they're more than just operational hiccups. They're a direct hit to the bottom line.

Margins in construction are still tight. We see this with material costs climbing and labor remaining unpredictable. And despite the best planning efforts, more than 30% of projects are running over budget by 20 to 30% or more. The reasons are many. But the solution that leading contractors are leaning into is project-level financial control.

This isn't a buzzword. It's a set of real financial disciplines designed to help construction companies manage risk, control costs, and stay profitable despite market turbulence. Below, we break down what project-level financial control means, its impact, and how to put it into practice at your company.

The cost of losing financial visibility

Before we talk about tools and workflows, it’s important to understand what’s at stake.

When construction finance leaders lack job-level financial visibility, small overruns quietly snowball into serious issues. A missed labor variance on one project becomes a recurring loss on five. An unapproved equipment rental turns into a $50,000 surprise. When costs live in inboxes, credit card statements, or delayed reports, decision-makers are flying blind.

This is where project-level control comes in. It gives you the ability to forecast accurately, catch variances in real time, and hold every dollar accountable. And in 2025, companies doing this can drastically reduce cost overruns.

What is project-level financial control?

Project-level financial control is the process of managing costs, budgets, contracts, and approvals at the job level, not just across the company. This type of visibility turns each job into its own financial ecosystem, with clarity into spending, tight approval workflows, and proactive cost management throughout the project lifecycle.

This approach gives finance leaders the information needed to act fast. It gives project teams the tools to own their budgets. And it creates accountability across roles.

When implemented correctly, project-level control does more than prevent spend overruns. It builds trust between finance, operations, and the field team. It helps contractors scale confidently. And it turns the budget from a static document into a living tool for effective financial control.

Your 2025 guide to protecting project margins in a volatile market.

Project budget overruns are nothing new. But in 2025, they're more than just operational hiccups. They're a direct hit to the bottom line.

Margins in construction are still tight. We see this with material costs climbing and labor remaining unpredictable. And despite the best planning efforts, more than 30% of projects are running over budget by 20 to 30% or more. The reasons are many. But the solution that leading contractors are leaning into is project-level financial control.

This isn't a buzzword. It's a set of real financial disciplines designed to help construction companies manage risk, control costs, and stay profitable despite market turbulence. Below, we break down what project-level financial control means, its impact, and how to put it into practice at your company.

The cost of losing financial visibility

Before we talk about tools and workflows, it’s important to understand what’s at stake.

When construction finance leaders lack job-level financial visibility, small overruns quietly snowball into serious issues. A missed labor variance on one project becomes a recurring loss on five. An unapproved equipment rental turns into a $50,000 surprise. When costs live in inboxes, credit card statements, or delayed reports, decision-makers are flying blind.

This is where project-level control comes in. It gives you the ability to forecast accurately, catch variances in real time, and hold every dollar accountable. And in 2025, companies doing this can drastically reduce cost overruns.

What is project-level financial control?

Project-level financial control is the process of managing costs, budgets, contracts, and approvals at the job level, not just across the company. This type of visibility turns each job into its own financial ecosystem, with clarity into spending, tight approval workflows, and proactive cost management throughout the project lifecycle.

This approach gives finance leaders the information needed to act fast. It gives project teams the tools to own their budgets. And it creates accountability across roles.

When implemented correctly, project-level control does more than prevent spend overruns. It builds trust between finance, operations, and the field team. It helps contractors scale confidently. And it turns the budget from a static document into a living tool for effective financial control.

Twelve steps to project-level financial control

1. Define the project scope and financial ownership early

Start with a fully documented scope of work, clear milestones, and an approved budget. Identify who owns what; who approves spending, who tracks it, who reviews it. This ownership structure should be in place before the first dollar is spent on the project.

2. Use a construction-specific chart of accounts (COA)

Generic charts of accounts lack the granularity construction requires. Build a COA that includes cost codes by phase, category, and vendor type. Align it with how you build and how you report. Make sure it can support job-level financial analysis without extra spreadsheets.

3. Connect your field and finance systems

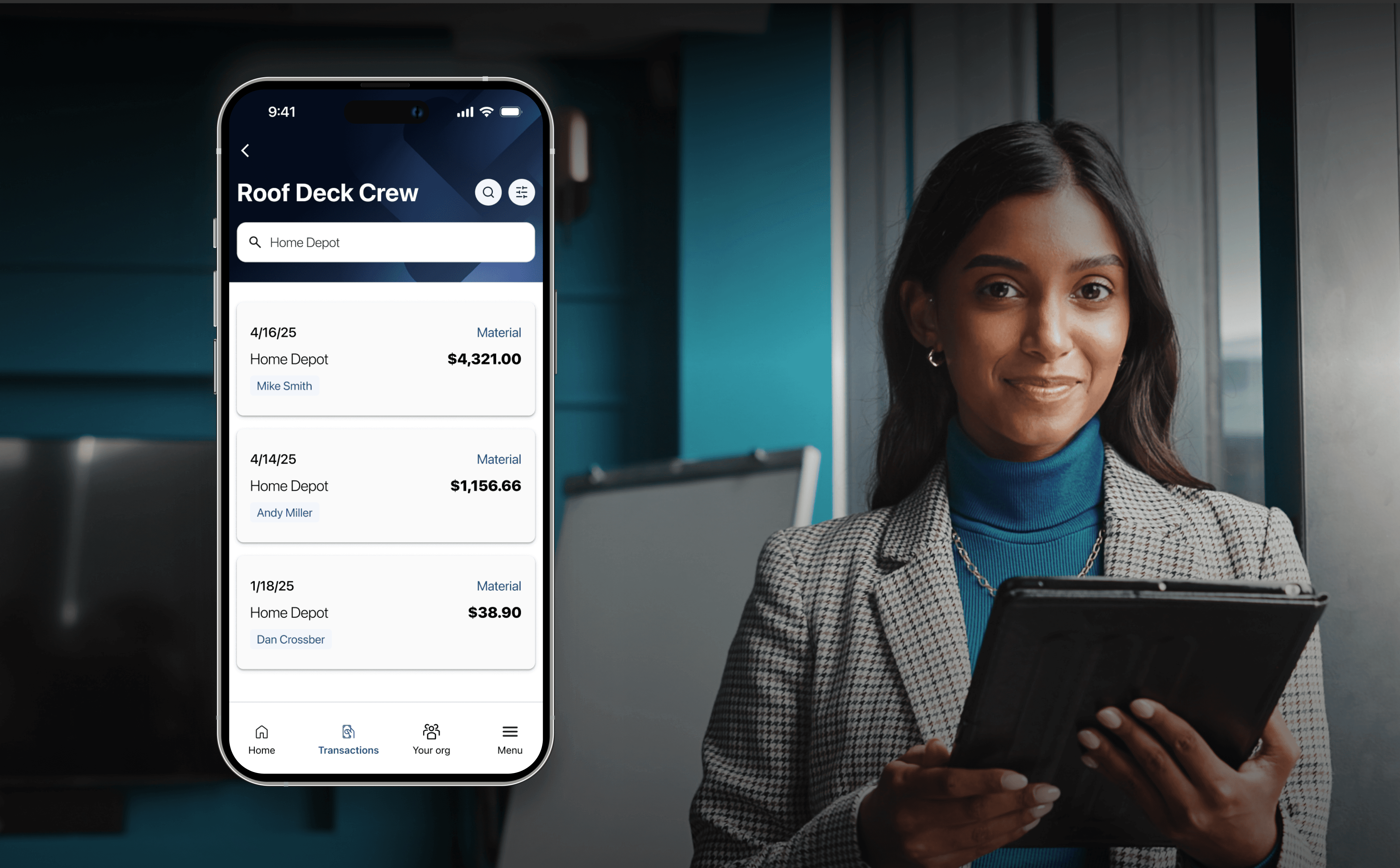

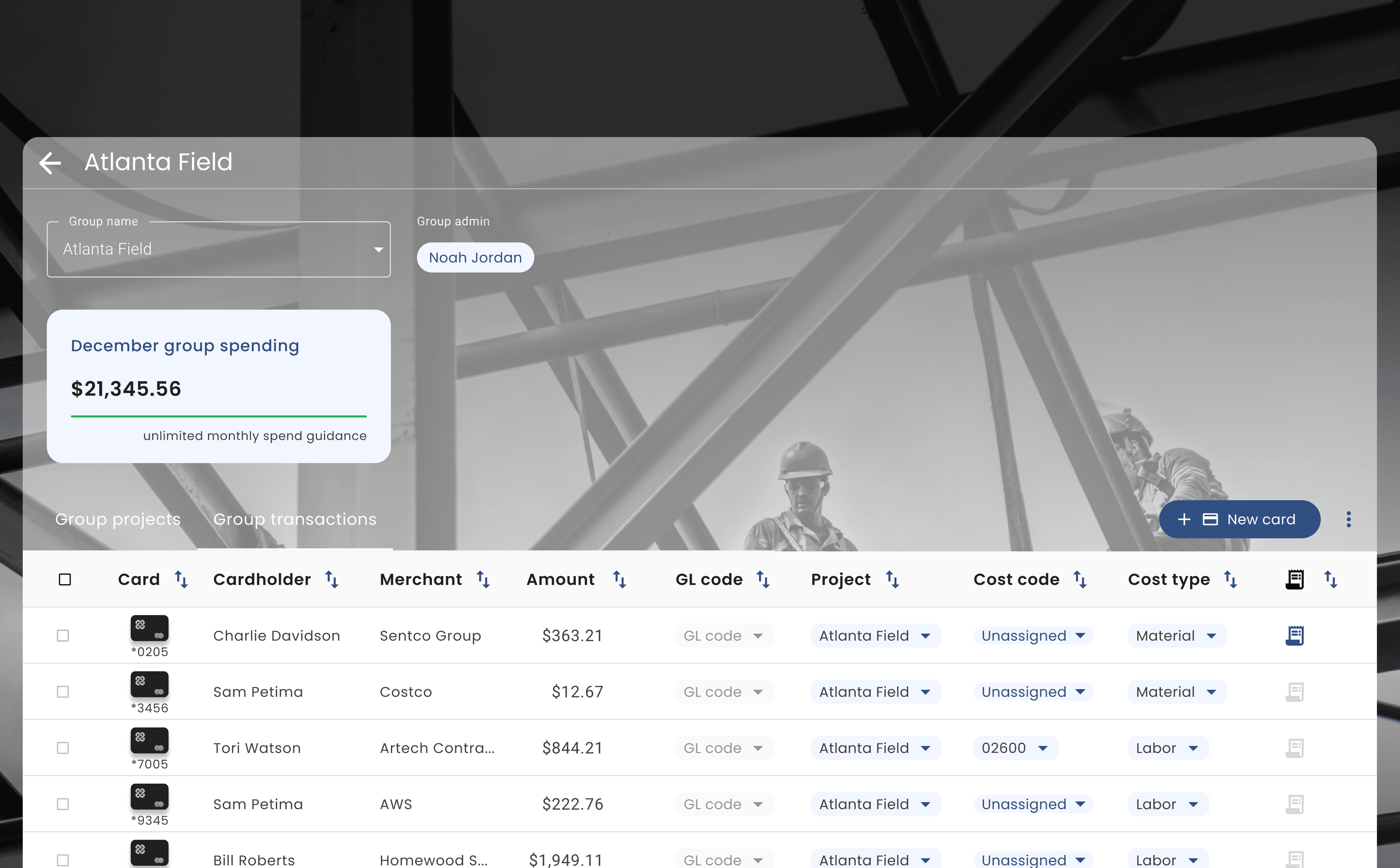

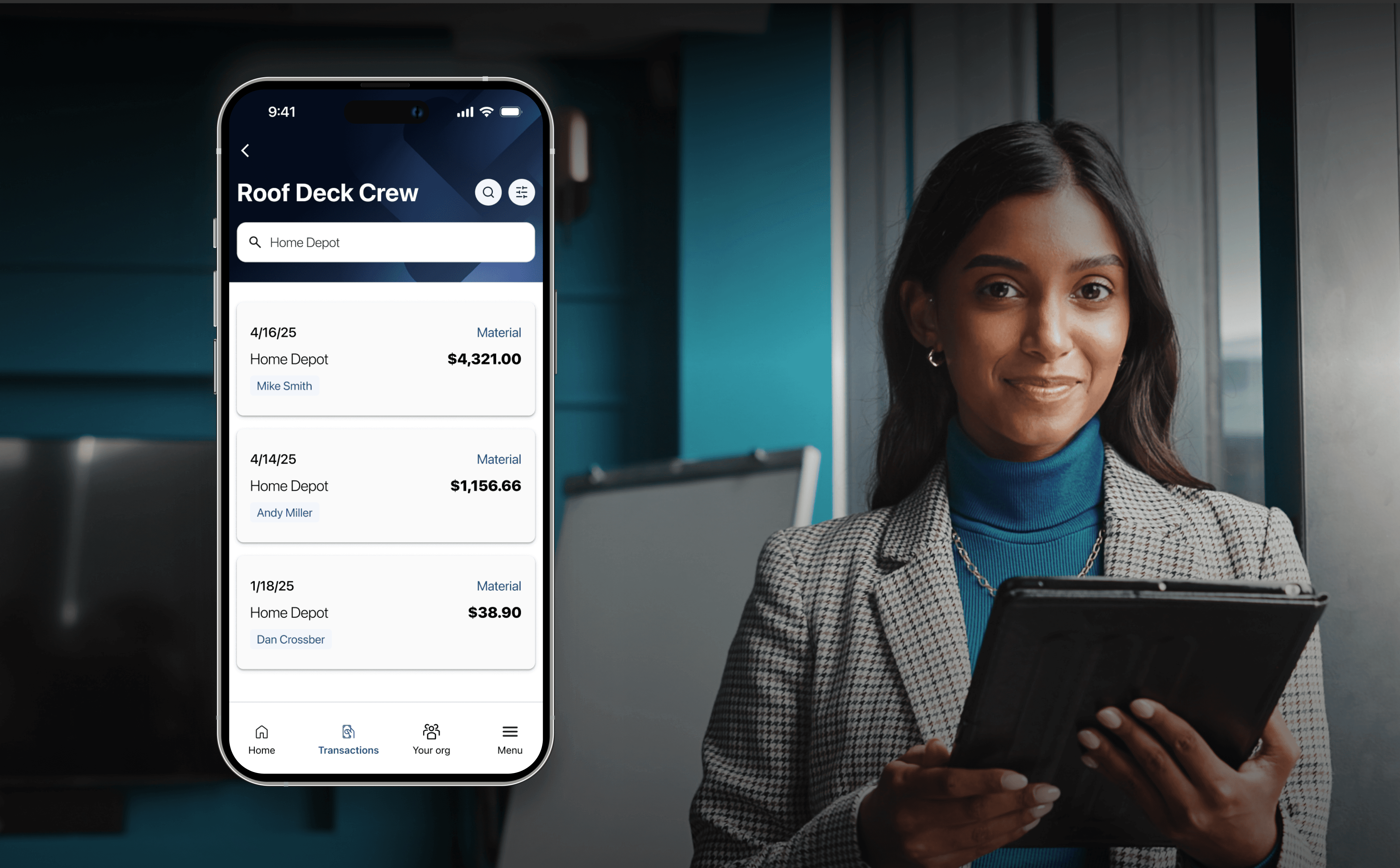

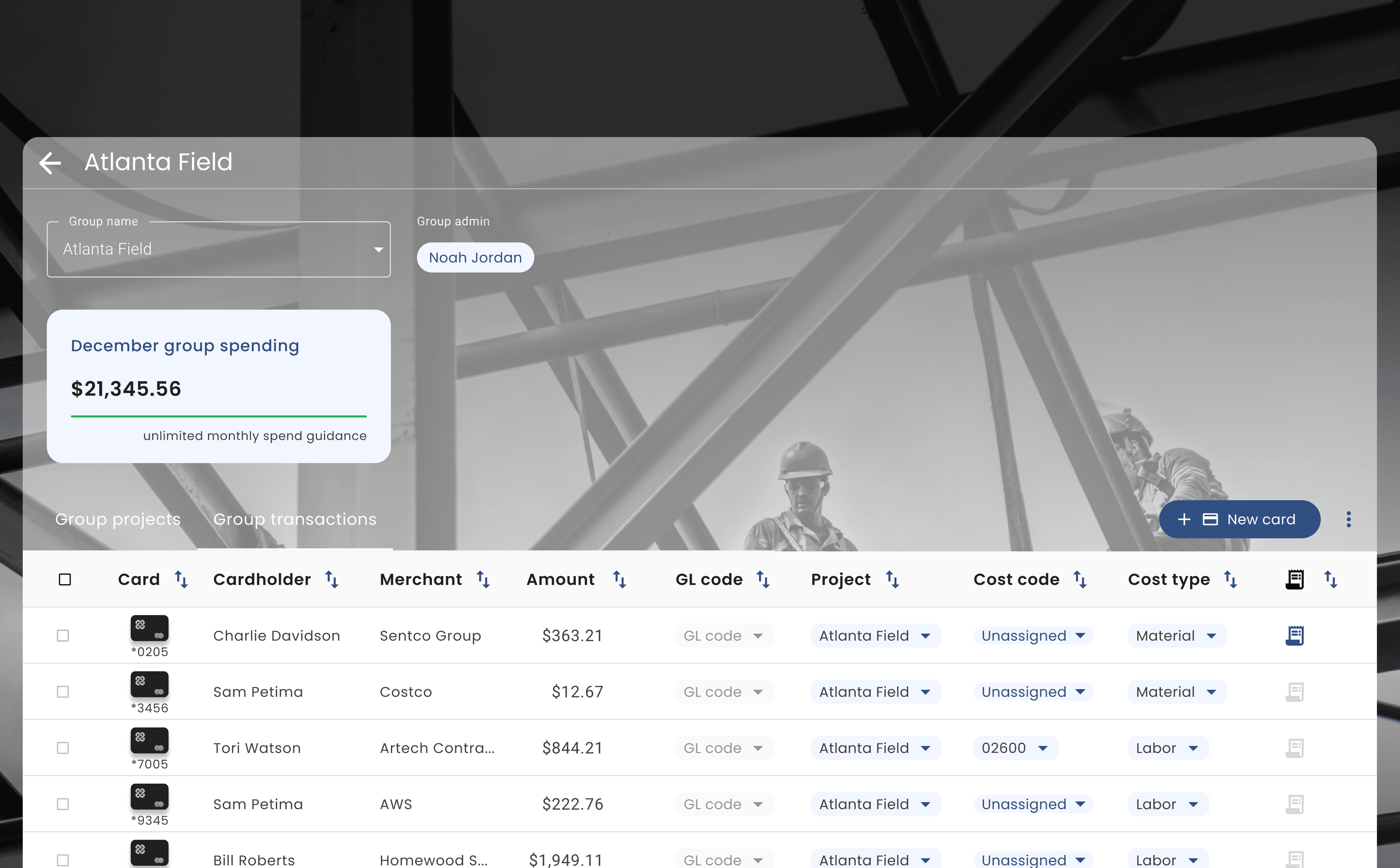

Disconnected systems create delays and confusion. Use tools like Procore for project management. Use Sage, QuickBooks, or Viewpoint for accounting. And use Speedchain to manage field spending in real time, with seamless integrations into accounting software, automated GL,Project, Cost Code, Cost Type, and Vendor tagging, and digital approvals.

Together, these tools close the loop between job site decisions and financial results.

4. Build a detailed, phase-based budget

A budget is more than a top-line estimate. An airtight budget is built from the ground up using vendor quotes, historical data, and real assumptions about labor, materials, and timeline risks. Include a 5 to 10% contingency. Ensure buy-in from project managers by scheduling time to walk through the budget parameters.

5. Lock in contracts with clear financial terms

Every contract, whether for subcontractors, suppliers, or service providers, should include specific terms for payment timing, retainage, change orders, and dispute resolution. Loose language at this stage can lead to budget drift down the road. A well-written contract protects both the project schedule and the bottom line.

6. Put internal controls in place

Establish processes that prevent overspending and ensure compliance. Assign roles for approval, purchasing, and reconciliation. Require two approvals for large or out-of-scope purchases. Review spending weekly, using tools that can streamline the process. Speedchain, for example, allows you set spend limits, categorize spend at the moment of purchase, and automate approval flows. Automated systems like this can effectively take approval workflows from hours to minutes.

7. Track spending in real time, not after the fact

When financial data lags behind the work, you lose the ability to manage outcomes. Live dashboards should display spend by group, project, cost code, cost type, and vendor. Field teams should be able to tag purchases to jobs instantly. Project managers should know how they’re tracking against budget at any point in time. This is what separates reactive teams from proactive ones.

8. Link billing to progress milestones

If your billing cycle doesn’t align with project progress, your cash flow will suffer. Use milestone-based or percent-complete billing. Automate invoicing reminders. Monitor collections closely. Maintain a 13-week cash flow forecast for every project. A profitable job that runs out of cash still hurts the business.

9. Automate labor cost tracking

Labor is often the largest single cost on a project, and one of the hardest to control. Use job-specific time tracking tools. Automate payroll feeds into your accounting system. Track compliance with union rules, fringe rates, and tax laws. The more accurately you track labor costs by job and phase, the more precisely you can forecast and bill.

10. Report weekly and meet regularly

Make job-level reporting habitual. This might include sharing weekly reports with leadership on budget vs. actuals, cost-to-complete, and margin status. Highlight any phase trending over budget. Meet with project teams regularly to review results and agree on next steps. When finance leads the conversation, teams start to treat the numbers seriously.

11. Conduct post-mortems on every job

At closeout, don’t just submit the final invoice. Sit down with your team and review the full financial picture. What was over budget and why? How did your estimates perform? Use this insight to refine your cost codes, update your estimates, and improve the next job.

12. Audit regularly and update your controls

Review your internal controls each quarter. Make sure your approval workflows, card limits, and reconciliation processes are still working as intended. Bring in an external auditor annually to evaluate your systems. Then, use findings to make your processes stronger, not just compliant.

Twelve steps to project-level financial control

1. Define the project scope and financial ownership early

Start with a fully documented scope of work, clear milestones, and an approved budget. Identify who owns what; who approves spending, who tracks it, who reviews it. This ownership structure should be in place before the first dollar is spent on the project.

2. Use a construction-specific chart of accounts (COA)

Generic charts of accounts lack the granularity construction requires. Build a COA that includes cost codes by phase, category, and vendor type. Align it with how you build and how you report. Make sure it can support job-level financial analysis without extra spreadsheets.

3. Connect your field and finance systems

Disconnected systems create delays and confusion. Use tools like Procore for project management. Use Sage, QuickBooks, or Viewpoint for accounting. And use Speedchain to manage field spending in real time, with seamless integrations into accounting software, automated GL,Project, Cost Code, Cost Type, and Vendor tagging, and digital approvals.

Together, these tools close the loop between job site decisions and financial results.

4. Build a detailed, phase-based budget

A budget is more than a top-line estimate. An airtight budget is built from the ground up using vendor quotes, historical data, and real assumptions about labor, materials, and timeline risks. Include a 5 to 10% contingency. Ensure buy-in from project managers by scheduling time to walk through the budget parameters.

5. Lock in contracts with clear financial terms

Every contract, whether for subcontractors, suppliers, or service providers, should include specific terms for payment timing, retainage, change orders, and dispute resolution. Loose language at this stage can lead to budget drift down the road. A well-written contract protects both the project schedule and the bottom line.

6. Put internal controls in place

Establish processes that prevent overspending and ensure compliance. Assign roles for approval, purchasing, and reconciliation. Require two approvals for large or out-of-scope purchases. Review spending weekly, using tools that can streamline the process. Speedchain, for example, allows you set spend limits, categorize spend at the moment of purchase, and automate approval flows. Automated systems like this can effectively take approval workflows from hours to minutes.

7. Track spending in real time, not after the fact

When financial data lags behind the work, you lose the ability to manage outcomes. Live dashboards should display spend by group, project, cost code, cost type, and vendor. Field teams should be able to tag purchases to jobs instantly. Project managers should know how they’re tracking against budget at any point in time. This is what separates reactive teams from proactive ones.

8. Link billing to progress milestones

If your billing cycle doesn’t align with project progress, your cash flow will suffer. Use milestone-based or percent-complete billing. Automate invoicing reminders. Monitor collections closely. Maintain a 13-week cash flow forecast for every project. A profitable job that runs out of cash still hurts the business.

9. Automate labor cost tracking

Labor is often the largest single cost on a project, and one of the hardest to control. Use job-specific time tracking tools. Automate payroll feeds into your accounting system. Track compliance with union rules, fringe rates, and tax laws. The more accurately you track labor costs by job and phase, the more precisely you can forecast and bill.

10. Report weekly and meet regularly

Make job-level reporting habitual. This might include sharing weekly reports with leadership on budget vs. actuals, cost-to-complete, and margin status. Highlight any phase trending over budget. Meet with project teams regularly to review results and agree on next steps. When finance leads the conversation, teams start to treat the numbers seriously.

11. Conduct post-mortems on every job

At closeout, don’t just submit the final invoice. Sit down with your team and review the full financial picture. What was over budget and why? How did your estimates perform? Use this insight to refine your cost codes, update your estimates, and improve the next job.

12. Audit regularly and update your controls

Review your internal controls each quarter. Make sure your approval workflows, card limits, and reconciliation processes are still working as intended. Bring in an external auditor annually to evaluate your systems. Then, use findings to make your processes stronger, not just compliant.

Why this matters now

Mastering project-level financial control is the key to unlocking additional project profitability and creating long-term financial health inside of your organization. A streamlined approach empowers your team to forecast with greater precision and build a reputation for trust and reliability across every project.

Why this matters now

Mastering project-level financial control is the key to unlocking additional project profitability and creating long-term financial health inside of your organization. A streamlined approach empowers your team to forecast with greater precision and build a reputation for trust and reliability across every project.

About Speedchain

Speedchain is a financial operations platform purpose-built for construction. From instant card issuance and real-time spend tracking to automated cost code tagging and streamlined reconciliation, Speedchain helps contractors bring control to every jobsite and every dollar.

To learn more, visit www.speedchain.com or reach out to our team at sales@speedchain.com

About Speedchain

Speedchain is a financial operations platform purpose-built for construction. From instant card issuance and real-time spend tracking to automated cost code tagging and streamlined reconciliation, Speedchain helps contractors bring control to every jobsite and every dollar.

To learn more, visit www.speedchain.com or reach out to our team at sales@speedchain.com